We're thrilled to kick off a brand-new series aimed at deep-diving into crucial terms within the...

Decoding Real Estate Jargon: Understanding Equity in Syndications

Welcome back to our ongoing series, "Decoding Real Estate Jargon." In this installment, we'll delve into a fundamental aspect of real estate syndications: equity. Following our exploration of key terminology used in commercial real estate syndications, today's focus is on unraveling the intricacies of equity—the bedrock of investment in these ventures. Understanding its essence, sources, and applications is pivotal for both seasoned investors and those venturing into syndications for the first time. Let's unravel the layers of equity in the realm of real estate syndications.

Understanding Equity:

In the realm of real estate syndications, equity refers to the portion of ownership or capital invested in a property or project. It represents the interest that shareholders hold after deducting all debts from the property's total value and adding any closing costs, fees, or expenses not covered by debt. Equity is the backbone of real estate syndications, as it determines the financial stake and level of ownership for investors.

Investors who contribute equity effectively become part-owners of the property or project. This means they share in the potential profits and losses that arise from the investment. Additionally, they also bear a level of responsibility in the syndication, depending on their role. It's important to note that limited partners (LP) typically have limited to no responsibilities in a syndication, making it an attractive option for passive investors seeking to diversify their portfolio and generate passive income.

![]()

Sources of Equity:

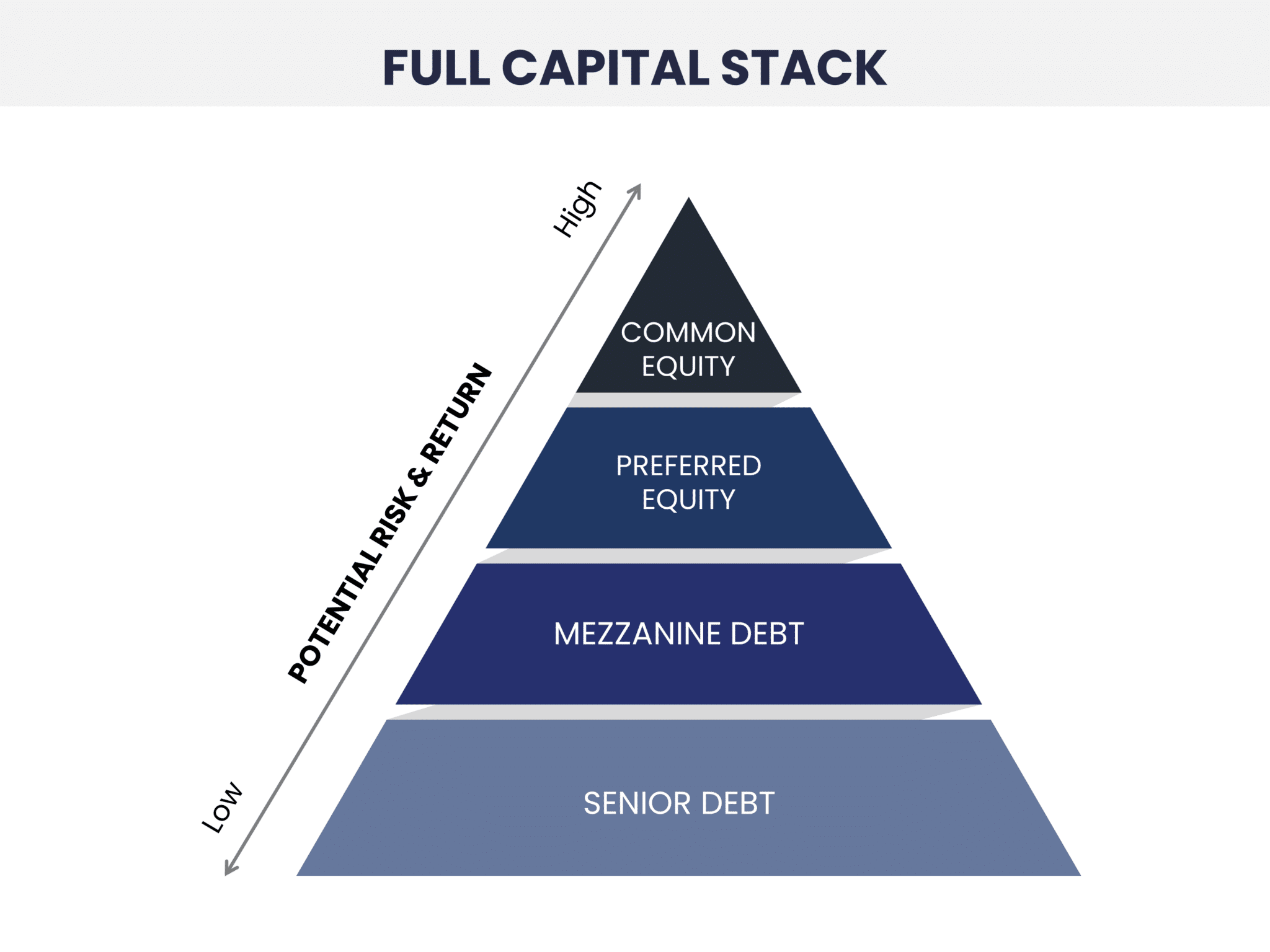

Equity in syndications can originate from various sources, showcasing the diverse range of investors involved in these ventures. While passive investors, also known as limited partners, are the principal contributors of equity, it's worth noting that general partners or sponsors can also play a significant role in funding these projects.

Passive investors, as limited partners, contribute funds to acquire or develop the property, making them crucial stakeholders in the syndication. Their financial support not only provides the necessary capital for the investment but also signifies their belief in the project's potential. By investing their own capital into the venture, general partners or sponsors further demonstrate their commitment and alignment of interests with passive investors, fostering a sense of trust and collaboration.

The involvement of both passive investors and general partners or sponsors ensures a well-rounded approach to equity, with each party bringing their unique perspectives and resources to the table. This diverse mix of contributors strengthens the overall foundation of the syndication and enhances the potential for success.

Uses of Equity:

The equity raised in syndications serves several critical purposes. Firstly, it acts as a down payment or initial capital required to acquire the property such as closing costs acquisition expenses and fees. This upfront investment ensures that the syndication has the financial resources necessary to secure the property and begin the investment process. By contributing equity, investors demonstrate their commitment to the project and align their interests with the success of the syndication.

Additionally, equity also covers operating expenses reserves and capital expenses such as property improvements. These expenses are essential for maintaining and enhancing the value of the property. From routine maintenance tasks to major renovations, the equity provided by investors ensures that the property remains in optimal condition and continues to generate income.

Furthermore, in value-add strategies, equity might be allocated for renovations, upgrades, or expansions aimed at enhancing the property's overall value. This approach involves identifying properties with untapped potential and implementing strategic improvements to increase their market value. The equity invested in these value-add projects allows for the execution of these enhancement strategies, such as remodeling outdated units, adding modern amenities, or expanding the property's square footage. These improvements not only attract higher-quality tenants but also enable the syndication to command higher rental rates and potentially sell the property at a higher price in the future.

Conclusion:

Equity forms the cornerstone of real estate syndications, representing the financial stake of investors in a property or project. Understanding the sources and applications of equity is vital for both passive investors and sponsors, as it determines the ownership structure, risk-sharing, and the potential returns on investment.

Let's Continue the Conversation: We invite you to engage with us in several ways:

-

Explore Opportunities: Discover how our syndications can improve your retirement plan. Contact us to explore investment opportunities and gain insights into the path to passive income. CLICK HERE to schedule a call.

-

Subscribe to Our Blog: Stay informed about the role of real estate in retirement planning. Subscribe to our blog and receive regular updates, expert advice, and success stories.

-

Connect on Social Media: Join our community on social media to interact with like-minded individuals who are also on the journey to a prosperous retirement.

CLICK HERE to schedule a call.

Download our free e-book at the link https://content.bluepathholdings.com/free-ebook.

By

By