Time to Be Greedy

In the ever-evolving landscape of real estate investing, astute investors recognize that market shifts and changing economic conditions can present incredible opportunities. The multifamily space is currently poised for a significant transformation, driven by rising interest rates, increasing insurance costs, and the normalization of rent growth. This blog post explores the exciting prospects unfolding in the multifamily market, where owners who purchased properties between 2020 and 2022 are facing challenges that may result in distressed sales. As a savvy investor, understanding these dynamics and implementing a value-add strategy can position you to capitalize on discounted property acquisitions and unlock substantial growth potential. In the words of Warren Buffet, "be fearful when others are greedy, and greedy when others are fearful." Now is the time to embrace the opportunity and make strategic moves, time to be greedy.

-

The Confluence of Factors:

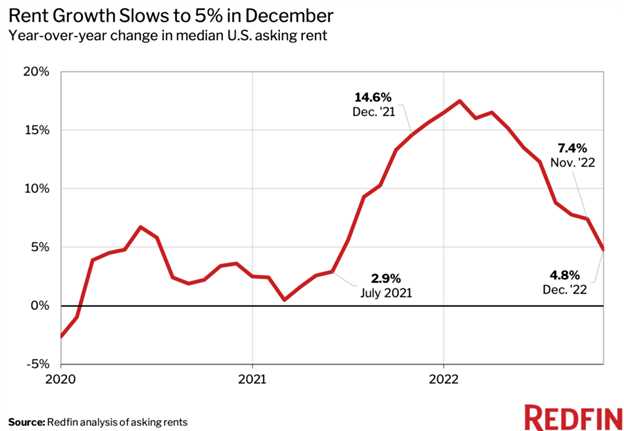

Rising Interest Rates, Insurance Costs, and Rent Growth: Several key factors are converging in the multifamily space, creating a unique market environment primed for investment opportunities. First, the fed has been increasing interest rates, and is expected to continue this until at least the third or fourth quarter of 2023, impacting borrowing costs and placing financial strain on property owners who bought during the low-rate period of 2020 to 2022 with variable rates. Second, insurance costs are on the rise, further burdening property owners and affecting overall property performance. Lastly, rent growth is normalizing, while we saw double digit rent increases year over year through 2021 and 2022, in some markets over 20% increases, we are now seeing rent growth starting to stabilize to an average 5% and we expect that to be around 3% for the next year or two, providing an even tougher time for those sponsors that underwrote a 10% YoY rent increase through 2025. All those factors are pushing up capitalization rates (CAP) for multifamily assets, the higher the CAP rate the lower the price, this affect valuations and current owners that are having trouble cannot refinance and or force to sale, or even worst lenders will take over the property once as soon as the net operating income of the property goes below 1.25% of the mortgage payment, resulting in those foreclosed assets hitting the market at even lower prices.

-

Distressed Sales and Opportunities:

As mentioned above, the combined impact of rising interest rates, insurance costs, and normalized rent growth is placing financial pressure on owners who may be forced to sell their properties or face the risk of foreclosure. This predicament creates a market scenario ripe with distressed sales and potential acquisition opportunities. Many passive investors and even multifamily sponsors would let fear take over and paralyze them, but Investors with a keen eye and a thorough understanding the opportunity and through the right implementation of value-add strategies can leverage these circumstances to acquire properties at discounted prices and capitalize on their growth potential over the coming years, the multifamily, historically, multifamily properties have shown appreciation over the long term. As demand for rental housing continues to grow, particularly in desirable locations, property values can increase, leading to potential capital appreciation.

-

Implementing a Value-Add Strategy:

To maximize the potential of these discounted acquisitions, it is crucial to employ a well-executed value-add strategy. This approach involves identifying properties with untapped potential and implementing strategic renovations, upgrades, and operational improvements to increase their value and attractiveness to tenants. By adding amenities, enhancing curb appeal, improving unit interiors, and optimizing property management practices, investors can drive rental income growth, boost property appreciation, and achieve significant returns on investment.

-

Long-Term Growth and Multiplication:

Investing in distressed properties with a value-add strategy offers the potential for long-term growth and multiplication of investment returns. As market conditions normalize and the value-add enhancements are implemented, properties have the opportunity to experience increased rental demand, higher occupancy rates, and improved cash flow. Moreover, the strategic timing of these acquisitions allows investors to ride the wave of the market recovery, positioning them for substantial appreciation and ongoing success in the multifamily space.

The multifamily market is undergoing a transformative period, presenting an exceptional opportunity for astute investors to capitalize on changing market dynamics. As interest rates rise, insurance costs increase, and rent growth normalizes, property owners who bought between 2020 and 2022 are facing challenges that may lead to distressed sales. By seizing these opportunities not giving into the fear and implementing a value-add strategy, investors can acquire properties at discounted prices, unlock their full potential, and achieve significant growth and multiplication of their investment returns. Now is the time to be proactive, embrace the opportunity, and position yourself for success in the multifamily market as Buffet said, be greedy. With careful analysis, conservative underwriting, strategic decision-making, and a forward-thinking approach, we at Blue Path Holdings can help you navigate this exciting market environment and capitalize on the multifamily opportunity of a lifetime, the sooner we start the conversation the better prepared and positioned we will be for when those opportunities present,CLICK HERE to schedule a call.

Download our free e-book at the link https://content.bluepathholdings.com/free-ebook.

By

By